The 2025 tax year (filing in 2026) is shaping up to be an eventful one for tax planning, with both predictable and uncertain changes on the horizon.

Known Changes: Routine Inflation Adjustments

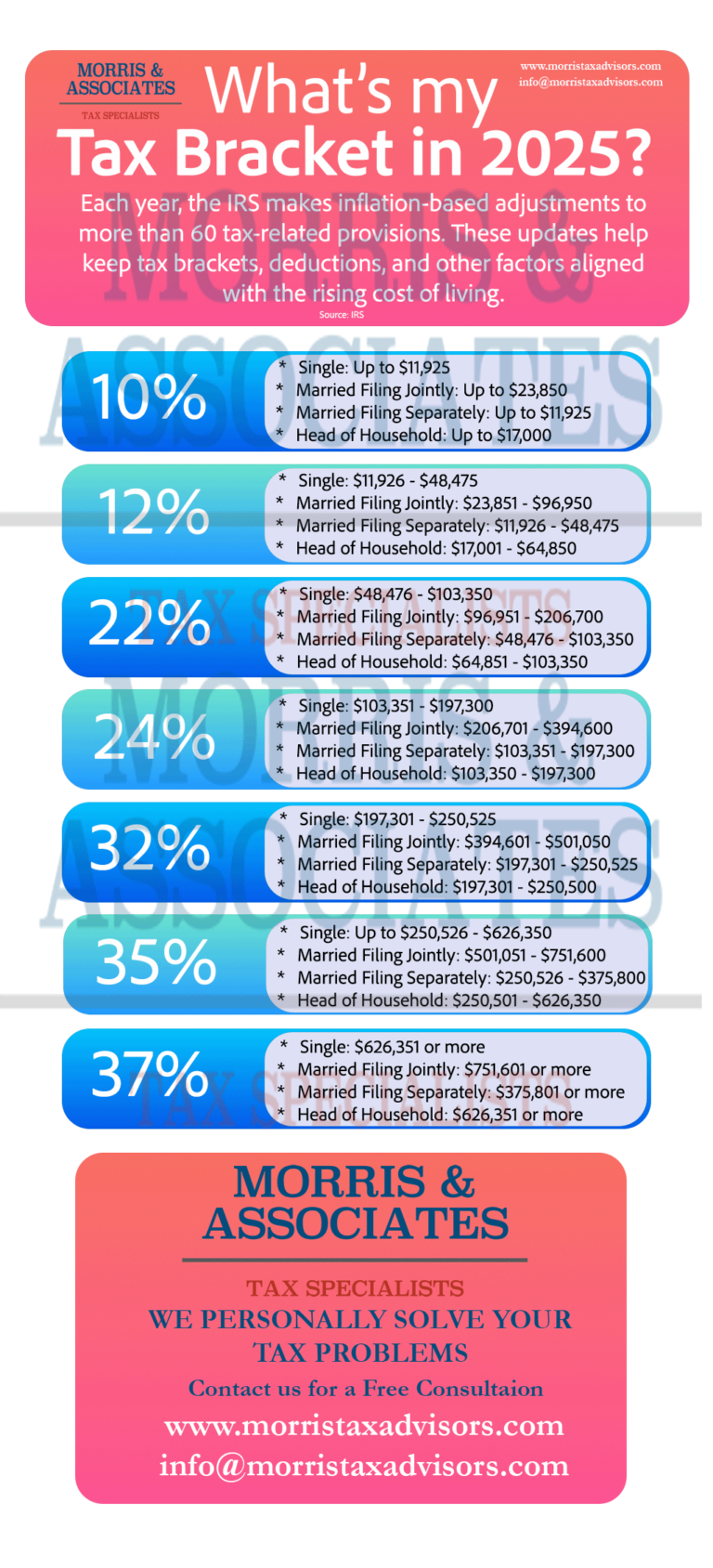

Each year, the IRS makes inflation-based adjustments to more than 60 tax-related provisions. These updates help keep tax brackets, deductions, and other factors aligned with the rising cost of living. For 2025, these adjustments will lead to an average increase of about 2.8%.

Unknown Changes: Potential Expirations and Legislative Updates

Some of the bigger shifts could come from tax provisions set to expire at the end of 2025. These include:

- Standard deduction amounts

- Individual income tax rates

- Limits on state and local tax (SALT) deductions

- Deductions for small business owners

- Estate tax exemption limits

With a new administration in Washington, potential legislative changes could impact these expiring provisions and other tax policies. Staying informed will be key to navigating tax planning in the coming year.

2025 Tax Brackets and Rates

The seven federal tax rates remain unchanged at 10%, 12%, 22%, 24%, 32%, 35%, and 37%. However, the income thresholds for each bracket have been adjusted slightly higher for inflation.

For high-income filers, a key threshold to note is $197,300 for single filers and $394,600 for married couples filing jointly. These are the points at which taxpayers move from the 24% tax bracket to the 32% bracket. The highest marginal rate of 37% applies to taxable income exceeding $626,350 for single filers and $751,600 for joint filers.

Standard deduction 2025

The standard deduction represents the amount of income you can exclude from taxes before the above tax rates begin to apply.

The 2025 standard deduction increases by $400 for single filers and by $800 for joint filers. People over age 65 or the blind may claim an additional standard deduction of $2,000 for single filers and $1,600 for joint filers. In addition, the standard deduction amount for an individual who may be claimed as a dependent by another taxpayer cannot exceed the greater of $1,350 or the sum of $450 and the individual’s earned income.

Select a Trusted Tax Professional

Tax professionals such as Morris and Associates are authorized IRS e-file providers, qualified to prepare, transmit, and process electronically filed tax returns efficiently and securely.

Morris and Associates are experts when it comes to helping individuals and companies save money when filing their taxes in Georgia but can help no matter where you live or whatever tax questions you have. Contact us to help with your taxes and possibly even reduce the amount that you owe.