Deadline Looms: IRS Urges Businesses to Rectify Employee Retention Credit Claims

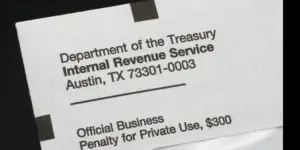

March 22 Deadline With a key March 22 deadline rapidly approaching, the Internal Revenue Service renewed calls for businesses to review the Employee Retention Credit (ERC) guidelines to avoid future compliance action for improper claims. Amid aggressive marketing that misled