The offer-in-compromise process is a way for taxpayers to settle their tax debt for less than the full amount owed. This can be an attractive option for taxpayers who are unable to pay their full tax bill, or who want to avoid the hassle and expense of litigation.

The thing is, when you owe the IRS money, they are not going to just let it go. If you can’t pay your tax bill in full, you may be able to negotiate an offer-in-compromise (OIC) with the IRS.

This process can be complex, so it’s important to understand all of your options before you submit an offer. In this article, we will discuss the basics of the OIC process and what you need to do to qualify for this program.

There is no legal right to have your taxes reduced by the IRS, and it is entirely at the discretion of the government agency.

The IRS must, however, give a properly completed OIC reasonable consideration in almost all cases. In recent years, up to 40% of the OICs submitted were accepted by the IRS, which was somewhat higher than in prior years.

The Qualifications for OIC

The IRS will only consider an OIC if you can demonstrate that your tax liability is correct and all of the necessary paperwork has been submitted.

If you owe a large amount of taxes, this may not be possible because it would take a long time to gather all of the required documentation. In addition, your business income may fluctuate from year-to-year, making it difficult to prove your ability to pay.

OICs are only available for certain types of taxes and not others. If you have a tax liability that is less than $50,000 and meets the following requirements:

If you have been in business for at least three years, and your total tax liability is less than $50,000 for the most recent three-year period you may be able to submit an offer that includes a lump sum payment of the full amount owed, minus 20% of the offer amount.

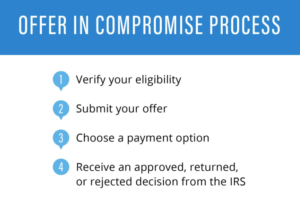

The Offer-In-Compromise Process

If you meet the qualifications for an OIC, the next step is to submit an offer. This can be done online, or by mailing in a paper application. You will need to provide detailed information about your assets, liabilities, and income.

Taxpayers who want to file for an OIC must fill out Form 656-L and understand that the offer is based on the argument that it is unclear whether the tax assessed was correct.

In addition, you must include a $186 processing fee with your offer.

If the IRS accepts your offer, they will send you a letter to that effect. If they do not accept it, they will send you another letter explaining why this is so and asking for more information if necessary.

If your offer is rejected by the IRS, there are several things you can try before giving up hope of negotiating an OIC with them:

1. Send additional financial information such as bank statements, pay stubs, or tax returns to support your offer.

2. You can also try to negotiate a payment plan with the IRS if you cannot afford to pay the full amount of your tax bill. This will allow you to make smaller payments over time and avoid additional penalties and interest.

3. If all else fails, you can always try to sue the IRS. This is a costly and time-consuming process, so it should only be used as a last resort.

The Downside To Submitting An Offer In Compromise

There are some downsides to submitting an offer in compromise. The first is that the IRS will not accept your offer until you have paid all taxes owed for at least three years, including any penalties and interest accumulated since then.

The second downside is that if they do accept your OIC, there’s no guarantee they’ll ever come after you for the money again. This means that even if you do make payments over time, the IRS could still come after you for the full amount at a later date.

Finally, offers in compromise are often quite complex and it can be difficult to prove your eligibility. If you’re not sure whether or not an offer is right for you, consult a tax professional before proceeding.

How Much Should You Offer?

The amount you offer in an OIC is based on a number of factors, including your income, assets, and liabilities. In most cases, the IRS will only accept offers that are less than the full tax liability owed.

Conclusion

The offer-in-compromise process can be a great way for taxpayers who are unable to pay their full tax bill to settle their debt for less than the amount owed. However, it’s important to understand that offers are not always accepted and there may be other options available for those who aren’t eligible for an OIC. If you’re considering filing an OIC, it’s important to first consult with a tax professional about whether this is the best option for you and your financial situation.

Get Compliant and Get Tax Relief

Morris and Associates are experts when it comes to helping individuals and companies find tax relief in Georgia but can help no matter where you live or whatever tax questions you have. Contact us to help with your taxes and possibly even reduce the amount that you owe.